Lot Size Calculator

What are Leverage & Margin in Trading?

Leverage allows a trader to control a larger position using less money (margin) and therefore greatly amplifies both profits and losses. Leveraged trading is also called margin trading.

Leverage will amplify potential profits and losses. For example, buying the EUR/USD at 1.0000 with no leverage, to take a total loss the price must go to zero, or to 2.0000 to double your investment. If you trade using the full 100:1 leverage, a price movement of 100 times less will produce the same profit or loss.

Margin is the capital a trader must put up to open a new position. It is not a fee or cost and is freed up again once the trade is closed. Its purpose is to protect the broker from losses. When losses cause a trader's margin to fall below a pre-defined stop out percentage, one, or all open positions, are automatically closed by the broker. A margin call warning from the broker may or may not precede such liquidation.

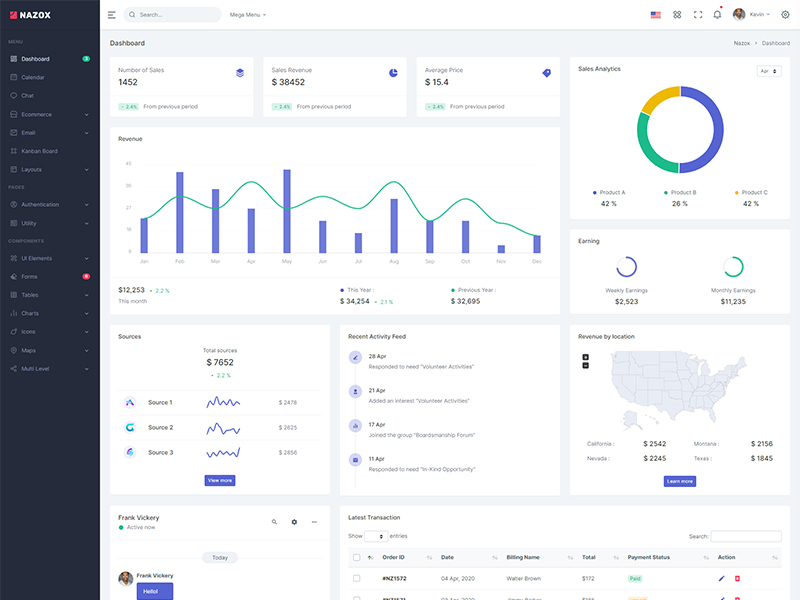

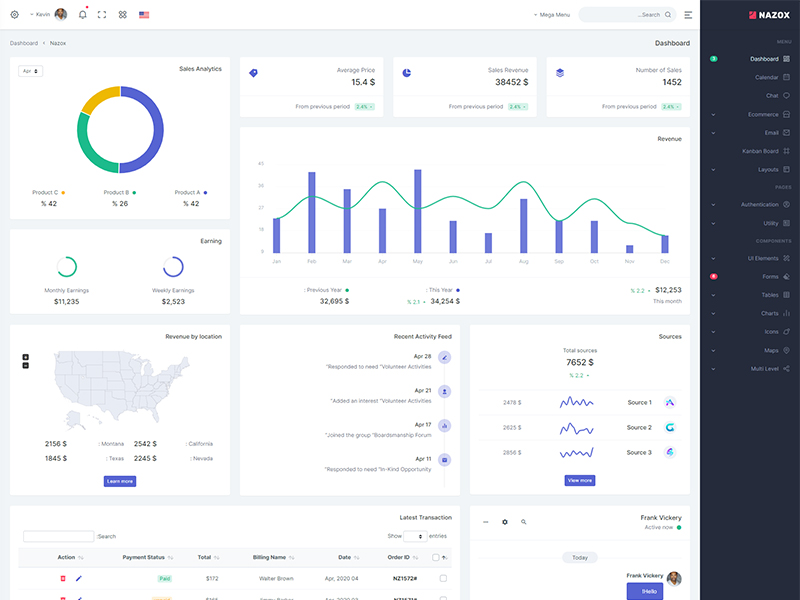

Instrument: In this field, traders can select from several forex crosses, including major and minor pairs, popular cryptocurrencies (ADA, BTC, DOGE, ETH, LTC, Stellar, Ripple, etc), popular indices, and commodities like Gold, Silver, and Oil. For our example, let's choose the EUR/USD pair.

Deposit currency: Margin values differ for forex pairs and other financial instruments and are subject to the current market quote. By selecting the deposit currency, you can accurately display the margin required to open a position for the chosen instrument in your selected currency (from AUD to ZAR). For this example, let's choose GBP as our deposit currency.

Leverage: In this field, traders need to input a leverage ratio. It can be the current leverage offered by the broker or any other ratio, ranging from as little as 1:1 to 6000:1, to simulate the amount of margin used to open a position. For our example, let's select a leverage of 30:1.

Lots (trade size): Enter the lot size in this field. In forex, 1 lot is equal to 100,000 currency units, but the units per lot vary for non-forex pairs. You can also switch between lots and units for calculations. For our example, let's use a trade size of 0.10.

Next, click the "Calculate" button.

The results: Using the given data, the Leverage & Margin Calculator informs us that to open a trade position of 0.10 lot EUR/USD with 30:1 leverage and the current EUR/GBP exchange rate of 0.90367, a margin of 301.22 GBP is required.

TIP: The Leverage & Margin Calculator can also help find pairs that require less margin to trade. Using the same parameters (30:1 leverage and 0.10 lot trading position), if we choose the AUD/USD pair, we can see that the margin required to trade this pair would be much less, only 186.89 GBP.